Introduction to FIFO: What It Means and Why It Matters

In inventory management, FIFO (First In, First Out) is one of the most widely used and trusted methods. The basic concept behind FIFO is simple: the first products that enter inventory are the first ones to be sold or used. This principle is especially important for businesses dealing with perishable items, such as food, medicine, and certain consumer goods that may degrade over time.

FIFO is not only crucial for maintaining quality and minimizing waste but also plays an essential role in accounting and financial reporting. It provides an accurate reflection of inventory costs, impacting a company’s profitability and tax obligations.

In this guide, we’ll delve into the ins and outs of FIFO, explaining how it works, how to calculate ending inventory, and the benefits it brings to businesses. We’ll also explore how VVAP Global, a leading logistics and supply chain company, enhances the implementation of FIFO for its clients, especially those in the e-commerce sector.

What Does FIFO Mean?

FIFO (First In, First Out) is a system where the first items added to the inventory are the first to be used or sold. In essence, it means the oldest stock is moved out first, which is critical for industries with time-sensitive products like food, medicine, and technology that can become outdated or spoil if held too long.

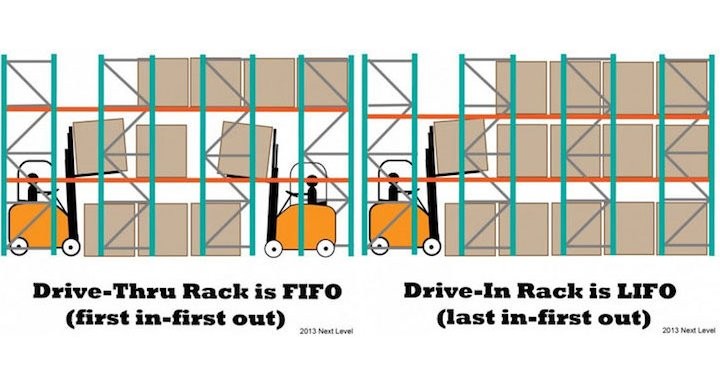

In contrast to LIFO (Last In, First Out), where the most recent items in stock are sold first, FIFO is widely regarded as a more practical and beneficial method, particularly for businesses that need to adhere to strict regulations or that must ensure product quality.

Why FIFO Is Essential for Business Operations

There are several reasons why businesses prefer the FIFO method:

Reduced Spoilage: For industries dealing with perishable goods, FIFO is crucial for reducing spoilage and minimizing waste. By ensuring older products are sold first, businesses can avoid expiration and obsolescence.

Improved Cash Flow: FIFO allows businesses to keep their inventory moving, which helps generate revenue more quickly. This reduces the amount of capital tied up in unsold stock.

Accurate Financial Reporting: FIFO provides a more accurate reflection of the cost of goods sold (COGS), especially during periods of rising prices. Since the oldest (and often lower-cost) inventory is sold first, the reported cost of goods sold is typically lower than with other methods like LIFO.

Regulatory Compliance: FIFO is often favored by tax authorities and accounting standards, making it the default choice for many companies. This method can also simplify compliance with accounting regulations, including IFRS and GAAP.

Customer Satisfaction: By ensuring that older products are used first, businesses can offer fresher items, improving customer satisfaction and product quality.

The Mechanics of FIFO: How It Works

The FIFO method is straightforward:

- The oldest products (first in) are sold or used first (first out).

- Remaining products in inventory reflect the cost of the most recently purchased goods.

This approach is beneficial during times of inflation, as the cost of goods sold will reflect older, often lower, prices. As a result, the ending inventory reflects the most recent costs, offering a more accurate snapshot of the current market conditions.

How to Calculate Ending Inventory Using FIFO

FIFO isn’t just a method for inventory movement; it also plays a significant role in determining the value of ending inventory and cost of goods sold (COGS). Here’s how to calculate ending inventory using FIFO:

Steps for Calculating Ending Inventory with FIFO:

Identify the Total Inventory Available for Sale:

- This includes the beginning inventory and all purchases made during the period.

Allocate Costs to Cost of Goods Sold (COGS):

- Under FIFO, the oldest inventory items are assigned to the cost of goods sold. This means you will deduct the cost of the oldest purchases first when determining COGS.

Determine the Ending Inventory:

- Once the COGS is subtracted from the total inventory available for sale, the remaining value will be the ending inventory, which represents the most recently purchased goods.

FIFO Formula for Ending Inventory:

Ending Inventory=Total Inventory Available for Sale−Cost of Goods Sold (COGS)\text{Ending Inventory} = \text{Total Inventory Available for Sale} – \text{Cost of Goods Sold (COGS)}Ending Inventory=Total Inventory Available for Sale−Cost of Goods Sold (COGS)

Example Calculation

Let’s consider a scenario where a company has the following transactions during a month:

- Beginning Inventory: 200 units at $5 each

- Purchase 1: 100 units at $6 each

- Purchase 2: 150 units at $7 each

- Sales: 300 units

Step 1: Calculate Total Inventory Available for Sale:

- (200 units × $5) = $1,000

- (100 units × $6) = $600

- (150 units × $7) = $1,050

- Total Inventory Available for Sale = $1,000 + $600 + $1,050 = $2,650

Step 2: Calculate COGS:

- 200 units at $5 = $1,000 (from beginning inventory)

- 100 units at $6 = $600 (from first purchase)

- Total COGS = $1,000 + $600 = $1,600

Step 3: Calculate Ending Inventory:

- Total Inventory Available: $2,650

- COGS: $1,600

- Ending Inventory = $2,650 – $1,600 = $1,050

The ending inventory is made up of the remaining 150 units at $7 each.

Advantages of Using FIFO

FIFO has a variety of benefits, especially in today’s fast-paced business environment:

More Accurate Financial Statements: FIFO offers a clear and accurate reflection of current market conditions in financial statements, particularly during inflation.

Simplified Operations: With FIFO, businesses don’t have to manage complex systems for tracking old and new inventory separately.

Increased Customer Satisfaction: FIFO helps ensure customers receive fresh, high-quality products, which can improve overall customer satisfaction.

Compliance with Accounting Standards: FIFO is generally accepted under both the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), making it an easier choice for businesses.

FIFO vs LIFO

While FIFO assumes that the first inventory in is the first sold, LIFO (Last In, First Out) operates in reverse. LIFO assumes that the newest stock is sold first. LIFO is often used during periods of inflation to reduce taxable income (as newer, more expensive goods are sold first), but it is less widely accepted internationally and can distort the balance sheet.

How VVAP Global Supports FIFO Implementation

VVAP Global is committed to helping businesses implement the FIFO method seamlessly, enhancing efficiency and profitability through a range of services tailored for e-commerce and logistics.

1. Technology-Driven Inventory Management

At VVAP Global, we leverage state-of-the-art software solutions to help businesses track inventory and ensure FIFO compliance. Our platform integrates with major e-commerce platforms like Shopify, WooCommerce, and Magento, automating the FIFO process to reduce human error and improve accuracy.

2. Customized Solutions for Every Business

Every business is unique, and VVAP Global understands this. We offer customized inventory management solutions that cater to the specific needs of our clients, ensuring smooth inventory turnover and minimal product wastage.

3. Efficient and Rapid Order Fulfillment

Our advanced fulfillment capabilities ensure that products are shipped efficiently, helping businesses move older stock out first. This not only preserves product quality but also ensures customers receive fresh, top-quality products.

4. Cost-Effective Logistics Solutions

By implementing FIFO, we help businesses reduce costs associated with inventory spoilage and holding obsolete products. Our logistics network is designed to minimize costs while maximizing efficiency, helping businesses boost their bottom line.

5. Expert Support and Training

We provide comprehensive training and ongoing support to ensure businesses fully understand FIFO and can effectively implement it. Our team of experts works closely with clients to ensure they are maximizing the benefits of the FIFO system.

FAQs on FIFO

1. What does FIFO stand for?

FIFO stands for “First In, First Out,” a method of inventory management where the first goods acquired are the first to be sold.

2. How does FIFO affect financial statements?

FIFO impacts financial statements by assigning the cost of older inventory to the cost of goods sold. This can result in lower COGS during times of inflation, leading to higher profits.

3. Why is FIFO preferred for perishable goods?

FIFO ensures that older stock is sold first, reducing the risk of spoilage and waste, making it ideal for industries like food and pharmaceuticals.

4. How does FIFO differ from LIFO?

FIFO assumes the oldest inventory is sold first, while LIFO assumes the most recent inventory is sold first. FIFO is generally more accepted and provides a better reflection of current inventory costs.

5. Can FIFO be used for all types of inventory?

While FIFO is beneficial for perishable goods, it can be used for all types of inventory, providing a practical method for ensuring accurate stock rotation.

6. How does VVAP Global help with FIFO?

VVAP Global provides customized inventory management solutions, integrating advanced technology to help businesses automate the FIFO process, improve efficiency, and reduce waste.